Many crypto enthusiasts and financial analysts believe that security tokens are the future of investment. They will likely fundamentally revolutionize compliance as they can represent any financial asset, whether it is equity, debt, or real asset. The industry is still very young, and there are not enough legal specialists working on essential regulatory issues. Clearly, with the development and implementation of the blockchain technology, more and more legal advisors trained in the crypto investment field will appear. When the regulations around security token stabilize and eventually settle down, the token will begin its ascend as a trusted and reputable investment asset. A great example of combining the power of blockchain technology and smart contracts to issue security tokens is Polymath (POLY).

Frank Pierce and Charles Ward, two fundraisers, could generate an incredible $4 million for the YMCA of New York City alone. Through a sound advertising strategy and face-to-face approaches, they established a trend of innovative fundraising campaigns that shaped the future of capital acquisition. The idea of fundraising was initially established in the early 1900s, and it was mostly linked with money generated for philanthropic reasons.

How is an STO different from an ICO?

One might be hard-pressed to think that the two are largely different but they are rather similar. However, in order to understand what an STO is, one must first understand ICO. The latter refers to a token offering from a company or organization in order to raise capital for a project. Unfortunately, ICOs are largely unregulated, thus putting investors at risk. One other key difference of an STO over an ICO is that the security token is fully regulated by security laws under certain jurisdictions. These security laws are very stringent and binding on projects looking to adopt this model of fundraising.

However, despite Switzerland’s pole position as ‘Crypto Nation’, the regulatory framework for security token projects remains unclear. Previously, with traditional paper backed assets like company’s shares or bonds or real estate, liquidity was a problem. However, cryptographic representation of all these things in a token form, can take care of that issue. The contract created for this loan will exist on the blockchain network and act as a security for the debt.

c. Look out for custodians to collateral assets for security tokens

The word ‘tokens’ immediately evokes thoughts concerning ICOs, a method for raising capital for crypto projects and popularized in 2017, which is where we’ll begin our journey. If they’re based in the US this typically mirrors traditional taxation schemes. As the Celo blockchain prepares to migrate into a layer 2 network on Ethereum, there’s suddenly competition to provide technology to the project.

An investor receives a crypto coin or token that represents his investment. However, a security token is an investment contract representing an underlying asset such as stocks, bonds, funds and Real Estate Investment sto in blockchain Trusts (REITs). A security is therefore a tradable financial instrument that has a certain value. So it is an investment product, behind which there is a real asset such as a company or real estate.

Summary of the benefits offered by the STO

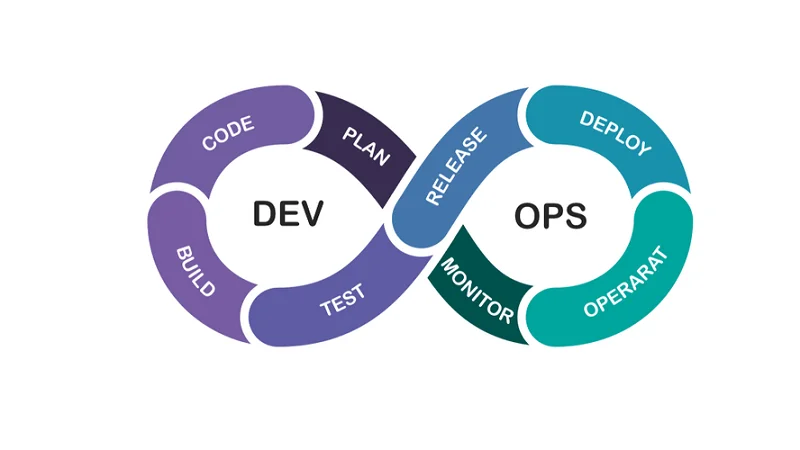

Therefore, STOs combine the technology of blockchain with the requirements of regulated securities markets. Security Token Offerings (STOs) are an innovative class of security tokens that represent traditional legal ownership of real-world assets. Security token offerings are a unique blend of digital tokens, security tokens, and conventional equity. They are a mechanism for start-ups, established companies, and legacy institutions to raise funds through the issuance of digital tokens. Real-world assets such as real estate leases, fiat, digital assets or shares of private companies, can be used as collaterals for security tokens. At the time of tokenization, the assets should be kept in the custody of third parties with mechanisms like Special Purpose Vehicles or Trust Companies.

- We’ve worked with many projects that develop their own token and so long as they’re compliant this can be a feasible route, but platforms such as Securitize and Harbor are good alternatives.

- Though the security token market has a long way to go, it is becoming more and more evident that it will reach significant levels of liquidity.

- Each role defined for the token has a specific purpose for which features can be decided as per the business needs.

- Many ICOs had very narrow applications as their tokens could only be used in niche networks.

- For example, the Securities and Exchange Commission (SEC) in the United States published a Decentralised Autonomous Organization (DOA) report in July 2017, which defined security offerings as an investment contract.

- For example, an Airbnb token, if it existed, would be useful for a person who wants to rent an apartment in another city, but won’t have any value outside the Airbnb ecosystem.

It allows investors to buy such assets without physically storing or exchanging them. Moreover, asset-backed tokens retain value so the token itself is a digital asset. Indicating that transparency is of the utmost importance, FINMA said that it will respond to ICO inquiries on a case-by-case basis, as not all ICOs may not always be subject to existing regulatory requirements. Currently, there is no specific ICO regulation, and there are no existing legal precedents or case law to which ICOs are specifically subject.

CHATERIUM NETWORK TESTNET PHASE #2

Additionally, information provided by the potential investment undergoes an approval process. When compared to the complete lack of checks found in the ICO sector, it’s easy to see why some investors look towards security token offerings for a better investment opportunity. Basically, security tokens represent securities that are actual assets, like bonds, stocks, or property trusts.

For stocks, ownership information is entered into a document as an official certificate of ownership. For security tokens, similar information is recorded, the major difference being that it is recorded on the blockchain and represented by a token. Security token offerings (STOs) have the potential to shape the evolution of traditional securities for real-world assets. The ability of STOs to provide tokenization for almost anything brings a new outlook to trade and asset-backed securities management.

A realistic, science-based, customizable, and aggressively self-tested morning system

This means that a security token always needs a platform that ensures that the latest regulatory requirements are met. In addition, only money from accredited investors who meet certain requirements are usually accepted. IPOs, as distinct from STOs, issue share certificates on traditional markets, while security tokens exist only on blockchain as digitized proof. The former is far less cost-effective than the latter, mostly because there is no intermediary in STOs. When a company goes public, it has to pay an army of lawyers and agents with their never-ending fees and brokerages. Security token offering implies more direct access to the market and is simply cheaper (and faster) to hold.

Consumer Token Offering is a new fundraising mechanism based on the blockchain that allows users to use the consumer token to purchase product or services. ERC-1404 standard is designed by the Tokensoft team to enable interoperability of different token standards, including ST-20 and R-token with cryptocurrency wallets and exchanges. Therefore, organizations and companies have come up with new standards that include address whitelisting and locking to ensure that tokens comply with security regulation. The network for ERC-20 tokens is so vast that exchanges and crypto wallets can integrate tokens built on ERC-20 standard quickly. Once the product is built and released to the public, you should also offer technical support services to provide technical help to the customers. To ensure the successful launch of an Security Token Offering, it is crucial to build a product that supports the launched security token.

The Security Token Offering (STO) and the Initial Coin Offering (ICO)

Company A can formally issue their security token to investors via an issuance platform. STOs have opened an opportunity for businesses to raise funds by issuing digital security tokens to investors in a regulatory-compliant manner. The advantages exist for both the investor and the issuer, while also providing much better assurances against fraud compared to an ICO. Issuers can come from a variety of areas, including commercial real estate, venture capital firms, and small and medium enterprises (SMEs).